Looking for a simple and powerful way to manage your payroll and HR needs?

🚀 You’ve come to the right place! This detailed guide on Gusto.com pricing will help you understand every plan, feature, and cost so you can pick the perfect fit for your business.

🔥 Get Free Gusto Trial – No Payment Needed

Whether you’re a small startup or a growing company, knowing your options will save you time, money, and headaches.

Ready to make payroll easier and more efficient?

Let’s dive in and find the best Gusto plan to help your business thrive! 💼🔥✨

Introduction

Gusto is an easy-to-use online platform that helps small and medium businesses manage their payroll, taxes, and HR tasks all in one place. It automates paying employees, filing taxes, offering benefits like health insurance, and handling important paperwork.

With Gusto, businesses can save time, reduce mistakes, and keep their teams happy without the usual stress of managing payroll and HR manually.

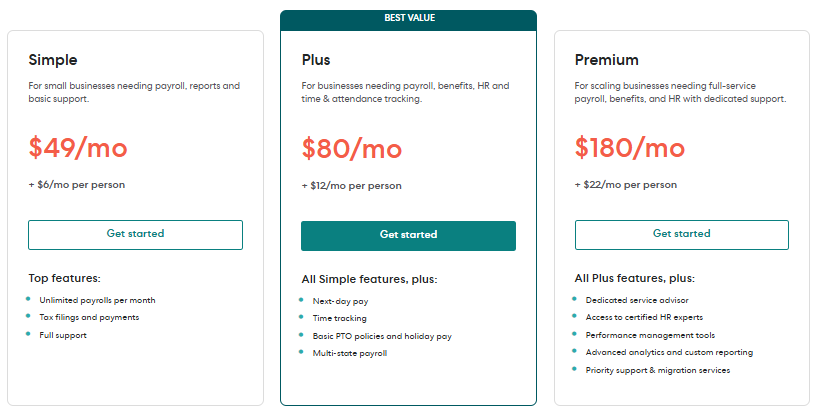

Gusto Pricing Plans for June 2026: Full Breakdown

Gusto offers different pricing options depending on your business size, payroll needs, and HR support requirements. Here’s a simple breakdown of what each plan includes so you can confidently pick the right one.

⭐ Simple Plan Pricing & Features

Pricing:

- $49/month base price

- + $6/month per employee

Best for:

Small businesses that only need basic payroll in one U.S. state.

What’s included:

- Full-service single-state payroll

- Unlimited payroll runs

- Automatic tax filing & payments

- Employee self-service portal

- PTO policies & reporting

- Basic hiring tools and onboarding checklists

- Integrations with accounting tools (e.g., QuickBooks)

Who shouldn’t choose this:

Teams with multi-state payroll or advanced HR support needs.

💡 If you’re just starting and want the lowest Gusto cost, this is usually the best plan.

💼 Plus Plan Pricing & Features (Best Value)

Pricing:

- $80/month base price

- + $12/month per employee

Best for:

Growing businesses needing time tracking + multi-state payroll.

What’s included:

Everything in Simple, plus:

- Multi-state payroll support

- Time tracking & PTO management

- Next-day direct deposit

- Performance reviews & people analytics

- Dedicated hiring & onboarding tools

- HR resource center + alerts for compliance changes

💡 If your team works across multiple states or you want stronger HR tools, pick Plus.

🚀 Premium Plan Pricing & Features

Pricing:

- $180/month base price

- + $22/month per employee

Best for:

Larger teams that require full HR support + advanced insights.

What’s included:

Everything in Plus, and:

- Certified HR advisor and compliance support

- Dedicated customer success manager

- Custom onboarding workflows

- Advanced performance management

- Migration assistance + priority support

- Advanced reporting and workforce analytics

💡 If you don’t want payroll or HR problems ever this is the safest choice.

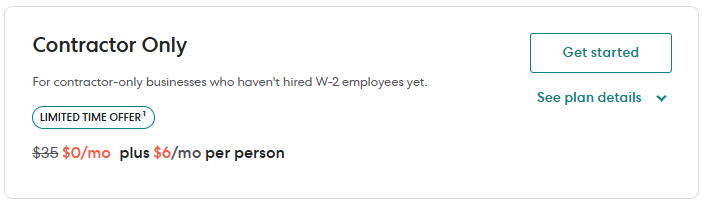

🧾 Contractor-Only Plan Pricing (Limited-Time Offer)

Pricing (Current Promo):

- $0/month base

- + $6/month per contractor

⏳ Earlier price was $35/month base but Gusto is currently waiving the base fee as a promotional offer.

Best for:

Contractor-only businesses who don’t have W-2 employees yet.

What’s included:

- Payments to contractors in all 50 U.S. states

- Fast direct deposit (4-day ACH)

- 1099-NEC forms at year-end

- Unlimited contractor payments

- Contractor self-service portal

Limitations (important!):

- ❌ No W-2 employee payroll

- ❌ No HR & benefits tools

- ❌ No time-tracking included

💡 Perfect if you’re just hiring freelancers, gig workers, or short-term project talent.

| Plan | Base Price | Per Person Fee | Best For |

|---|---|---|---|

| Simple | $49/mo | + $6/mo per person | Small businesses needing single-state payroll |

| Plus (Best Value) | $80/mo | + $12/mo per person | Growing businesses needing HR, time tracking |

| Premium | $180/mo | + $22/mo per person | Larger teams needing full HR and support |

Gusto Add-Ons and Extra Costs You Should Know

Even though Gusto advertises simple base pricing, many additional services and features depending on your business needs can add up. Before you commit, it’s smart to understand where extra costs might come from.

| Add‑On / Extra Feature | Cost / What to Expect | When You Might Need It / Why It Adds Cost |

|---|---|---|

| Time tracking (hourly, PTO, attendance) | ≈ $6/month per person | Useful if you have hourly or contract workers and need accurate time tracking, PTO, or shift‑based pay. |

| Next‑day payroll / faster deposit | $15/month + $3/month per person | Helpful when you want payroll to run close to payday for cash‑flow flexibility or last‑minute hires. |

| Priority support / HR resources / performance add‑ons | Paid add‑ons for users who need extra HR tools and faster support. | Ideal if you want enhanced HR support, management tools, or better compliance handling. |

| Benefits administration (health, dental, vision, 401(k), etc.) | You pay only the employee premiums; the provider handles admin with no extra platform fee for brokered plans. | Needed when offering insurance or retirement benefits to employees; adds recurring premium costs rather than platform fees. |

| Workers’ compensation | Premiums vary by state and company profile; provider manages filings and admin. | Required for compliance in many industries, especially if you have W‑2 employees. |

| International / global contractor or employee payroll | Extra fees may apply as part of global payroll or contractor management, especially for overseas payments. | Important if you hire remote or international contractors or expand beyond one country, which increases complexity and cost. |

| State tax registration / multi‑state compliance | Costs vary by state when operating across multiple states or tax jurisdictions. | Needed for businesses with employees in multiple states to stay compliant with local registration and tax rules. |

🔎 Key insight: Though Gusto’s base plans seem affordable, extras like time-tracking, faster payroll, benefits, and multi-state compliance can increase your monthly cost significantly especially as your team grows.

⚠️ Hidden Cost Traps to Watch Out For

- 👥 Per-employee fees grow fast — +$6 per person sounds small… until you have 20–50 employees.

- ➕ Add-ons can increase the bill — Time tracking, fast deposits, and benefits can double costs.

- 📈 Plan upgrades happen often — As your team grows, you may move to Plus or Premium (higher fees).

- 💸 Benefits mean ongoing expenses — Insurance and 401(k) premiums aren’t included in Gusto pricing.

- 🗺️ Multi-state payroll costs extra — Compliance and filings vary by state, adding surprise fees.

5️⃣ Is Gusto Pricing Affordable in 2025?

The short answer: Yes — but it depends on your team size and HR needs.

Gusto is designed mainly for small to mid-sized U.S. businesses, where the pricing structure offers strong value. You only pay:

- A base monthly fee

- A small per-employee fee

- Optional add-ons (only if needed)

So if you have 5–25 employees, Gusto’s transparent pricing model usually ends up cheaper than many competitors offering similar HR automation.

However…

As your team grows (30, 50 or 100+ employees), per-employee pricing can increase your monthly bill significantly.

Where Gusto pricing shines ✨

- Lower upfront costs than hiring HR/payroll specialists

- Automated payroll + taxes reduces costly mistakes

- Essential HR tools available even at lower tiers

- Flexible: upgrade anytime as needs grow

Where it can get expensive ⚠️

- Add-ons like time tracking and benefits raise total cost

- Multi-state payroll increases compliance fees

- Premium support and advanced HR tools require higher plans

📌 Bottom Line

| Team Type | Is Gusto Affordable? | Recommended Plan |

|---|---|---|

| Freelancers & contractor-only businesses | ⭐⭐⭐⭐⭐ Very cost-effective | Contractor-Only |

| Small teams 1–10 employees | ⭐⭐⭐⭐⭐ Excellent pricing | Simple |

| Mid-size teams 10–50 employees | ⭐⭐⭐⭐ Good — if add-ons are planned | Plus |

| Teams 50+ or HR-heavy operations | ⭐⭐⭐ Depends — costs increase fast | Premium / Select |

Verdict:

💡 If you want a payroll system that is easy to use, accurate, and scalable, Gusto offers one of the best price-to-value ratios in the entire U.S. payroll market.

Focus:

Start small → pay only for what you need → scale when your team grows.

How to Choose the Right Gusto Plan

Help readers decide which plan fits their situation.

Think about:

- Size of your team and where they work (single vs. multi-state)

- Whether you need HR support or time tracking tools

- Your budget and how much you want to spend monthly

- If you only work with contractors, Gusto has a special plan just for that

Starting with a smaller plan and upgrading as you grow is a smart way to go.

“If you plan to give payroll or HR control to a co-founder or accountant, it’s simple here’s a quick guide on how to add an administrator in your Gusto account.”

How to Add an Administrator to Your Gusto Account (step-by-step guide)

Tips to Save Money on Gusto Payroll & HR Plans

Keeping your Gusto costs under control is important to avoid paying more than you need. Here are some easy ways to manage your expenses while still getting the most out of Gusto:

1. Check Your Plan and Features Often

Look at your Gusto dashboard regularly to see which features you actually use and which ones you don’t. If you find some tools or add-ons that aren’t helping your business, consider removing them to save money.

2. Be Careful With Add-Ons

Gusto offers extra services like 401(k) plans, health insurance, and workers’ comp. Before adding these, think about whether you really need them now. Adding unnecessary extras can quickly increase your monthly bill.

3. Set a Clear Budget for Payroll and HR

Decide how much you want to spend each month on payroll and HR services. Keep an eye on your spending so you don’t go over your set budget.

4. Encourage Employees to Use Self-Service

Gusto’s employee portal lets your team handle things like viewing pay stubs or updating info themselves. This reduces work for you and your HR team, saving both time and money.

5. Avoid Payroll Mistakes

Double-check your payroll before running it to prevent costly errors like overpaying employees or missing taxes. Mistakes can lead to penalties or extra fees, which you want to avoid.

Gusto vs Justworks vs Rippling: Pricing & Value Comparison 🔥

Here’s how the big players stack up depending on your business size, needs, and growth plans.

🧮 Quick Comparison Table

| Provider | Starting Price / Fee Structure* | Ideal For | Strengths | Limitations / When It Gets Expensive |

|---|---|---|---|---|

| Gusto | From $49/mo base + $6/mo per employee | Small to medium U.S. businesses, straightforward payroll & HR needs | Transparent pricing, intuitive UI, payroll + tax filing + basic HR + benefits + time tools | Add-ons (HR tools, multi-state payroll, extra features) add cost; not ideal for global or highly complex orgs |

| Justworks | Per-employee fee model — fewer small-team entry costs, but overall per-employee cost tends to be higher | Companies wanting bundled payroll, benefits, HR + compliance peace of mind, especially under a PEO model | Payroll + compliance + benefits + HR bundled in one place; good for multi-state or regulated businesses | More expensive per employee, less flexibility, less cost-effective for very small teams or basic needs |

| Rippling | ~ $8–$10/mo per employee for core payroll/HR module (modular pricing; total depends on add-ons) | Growing startups/companies needing scalable HR + payroll + IT + global payroll capabilities | Unified HR + IT + payroll + finance stack; excellent automation, global payroll/contractor support, strong integrations | Cost increases with add-ons/modules; modular pricing can get complex; might be overkill for small simple teams |

*Prices and fees as of 2025 always re-check on the provider’s official site before publishing.

Pros and Cons of Using Gusto

Be honest and helpful by listing benefits and drawbacks.

Pros:

- Easy-to-use and intuitive platform

- Comprehensive payroll and HR features

- Transparent pricing with no hidden fees

- Good customer support and resources

Cons:

- Premium and Select plans require contacting sales for pricing

- Some features only available in higher-tier plans

- Can get pricey as your team grows and you add extras

Is Gusto Worth the Cost?

If your goal is to simplify payroll, automate taxes, reduce HR paperwork, and avoid compliance headaches, then Gusto is absolutely worth the price for most small and mid-sized U.S. businesses.

You get:

- Reliable payroll + automated tax filing

- Employee benefits and onboarding tools

- Compliance support as your business grows

- Transparent, predictable pricing

All without needing an expensive HR department.

Final Verdict

💡 For teams with 1–50 employees, Gusto offers one of the best price-to-value ratios in the entire payroll market.

It gives you peace of mind, saves time every month, and scales when you do.

If you manage a larger workforce or need advanced global tools, Rippling or a full HR outsourcing solution like Justworks may be better. But for U.S.-based SMBs, Gusto is a top recommendation.

“Related Article”

FAQs

Q1: Can I switch between Gusto plans anytime?

Yes, you can upgrade or downgrade your plan whenever needed without penalties.

Q2: Does Gusto handle tax filings for multiple states?

Multi-state payroll support is included in the Plus plan and above.

Q3: Is there a free trial available for Gusto?

Gusto does not offer a free trial but provides demos and personalized quotes.

Q4: Can I pay contractors through Gusto without employees?

Yes, the Contractor-Only plan is designed specifically for that.

Q5: Are there setup fees with Gusto?

No, Gusto does not charge setup fees for any of its plans.