Running a business is hard enough managing payroll, taxes, and employee benefits shouldn’t make it harder. That’s where Gusto comes in. 💼

Whether you’re a startup founder, a small team owner, or managing remote workers across the U.S., Gusto promises to take the stress out of HR and payroll with a simple, all-in-one platform. ➡️

🔥 Get Free Gusto Trial – No Payment Needed

In this post, we’ll break down how Gusto works, what real users are saying, its pricing, pros and cons, and whether it’s truly the right fit for your business in 2025.

👉 Ready to see if Gusto can save you time, money, and headaches? Let’s dive in.

📌1. A Quick Look at Gusto

Gusto is a cloud-based payroll & HR software made for small to medium-sized businesses. It helps you:

- Run payroll automatically

- Pay employees and contractors

- File taxes with ease

- Handle employee benefits and compliance

📌2. Gusto – Full Feature Breakdown

Gusto combines payroll, HR, onboarding, compliance, and benefits in one platform so small business owners can manage their team easily without needing expert HR knowledge.

✅ 2.1 All‑in‑One Payroll & HR Platform

Gusto handles payroll and HR from a single dashboard no need to juggle multiple tools.

Employers get a unified system to manage payroll, taxes, benefits, time‑tracking, and HR tasks, which makes staff administration easier and less error‑prone.

- Many modern HR teams now use CRM-style tools to improve employee experience and engagement. (Learn more about how CRM helps HR here.)

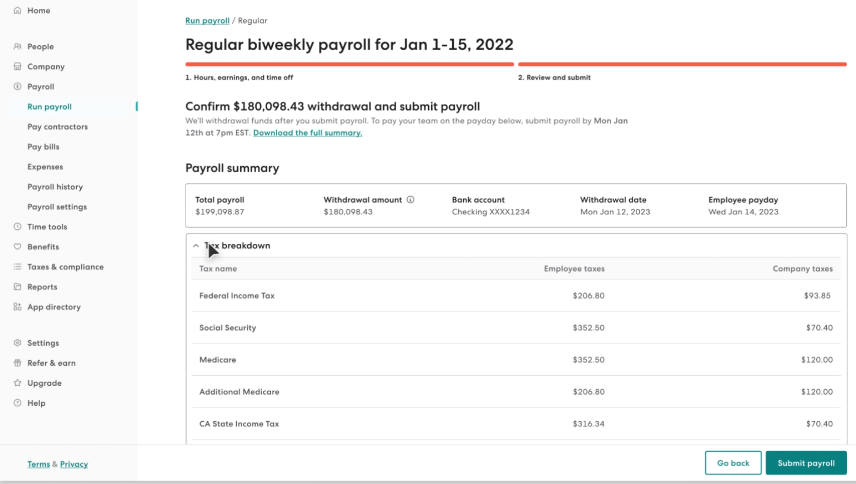

✅ 2.2 Full-Service Payroll with Automated Tax Filing

- Gusto submits federal, state, and local payroll taxes automatically.

- It handles W‑2s and 1099s generation and filing useful for both standard employees and contractors.

- Supports unlimited payroll runs ensures you can run payroll as often as needed without extra cost.

- Payroll can be scheduled or run manually. For many, you can even set up payroll to run automatically (no manual triggers needed).

This makes it much simpler than manual payroll or spreadsheet‑based methods, especially for small businesses.

✅ 2.3 Flexible Payment Options & Contractor Support

- Supports both traditional employees and independent contractors this flexibility is useful for businesses with mixed workforces.

- Offers payment through direct deposit, paper checks, or payroll cards. You can also split payments or deposit to multiple accounts.

- Multiple pay rates and pay schedules are supported good for hourly workers, salaried staff, part‑time, etc.

✅ 2.4 Employee Records & Management (Clean HR Records)

Gusto keeps detailed (but not overwhelming) employee profiles: contact info, compensation, benefits, time-off balances, PTO accrual, and more.

The layout is clean and easy to navigate helpful whether you’re a payroll novice or experienced admin.

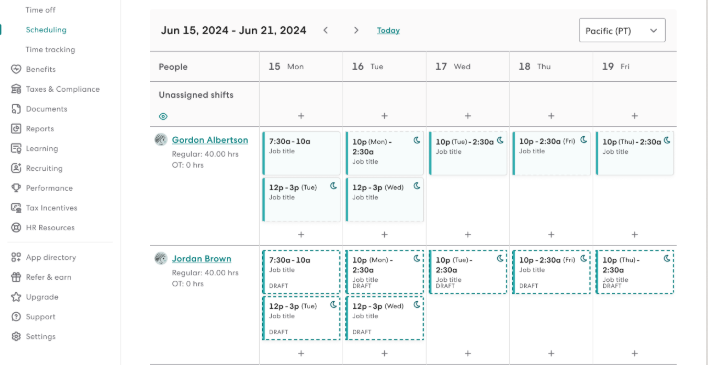

✅ 2.5 Time Tracking and Integration of Hours Worked for Payroll

- Built-in time‑tracking and timesheet support. Users can enter hours directly or import from integrated external tools.

- Works for salaried, hourly, or contract workers. Overtime, reimbursements, and bonuses are handled alongside standard wages.

This makes payroll calculations simpler and reduces manual errors on hours or overtime pay.

✅ 2.6 HR & Benefits Management Tools

- Gusto supports health benefits, retirement plans, insurance, and other benefits enabling small businesses to offer competitive compensation/benefit packages.

- Payroll deductions can be configured for benefits, savings accounts (like HSA/FSA), and even extras like gym memberships or employer‑matched charity contributions.

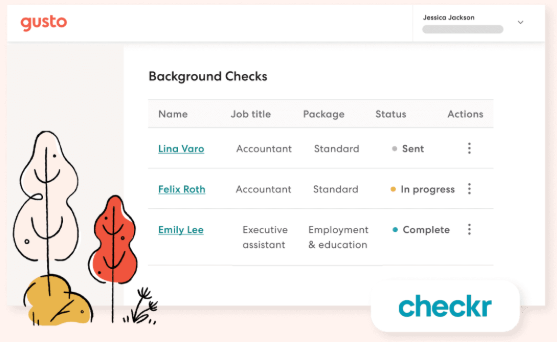

- Additional HR tools include hiring and onboarding workflows, compliance management, employee onboarding paperwork, and (on higher plans) more advanced HR admin features.

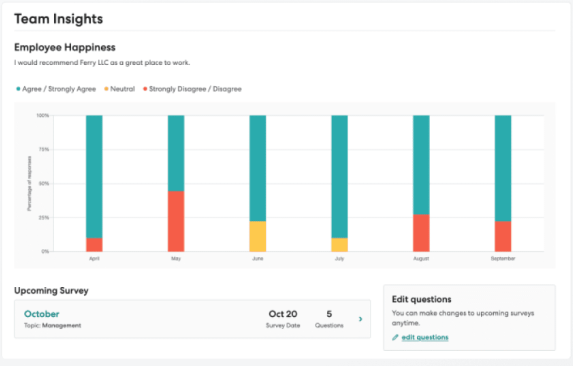

✅ 2.7 Reporting & Custom Reports

Gusto includes built‑in reports (payroll journals, tax summaries, time-off reports, etc.) that can be exported in PDF, CSV, or Excel formats.

A custom report tool lets admins drag and drop columns, filter data, specify date ranges, and save templates flexible for different business needs.

✅ 2.8 Usable, Beginner-Friendly Interface

According to PCMag, Gusto’s user interface is intuitive, clean, and well-designed. Payroll admins brand new or experienced find it easy to set up and navigate.

The combination of clarity, usability, and powerful features makes the payroll process smooth and less intimidating.

✅ 2.9 Admin & Employee Access (Self‑Service & Mobile Friendly)

Employees get access to their own portal to view paystubs, tax documents (W‑2/1099), PTO balances, and benefits.

Although PCMag notes there’s no full native mobile app for admins, Gusto’s mobile‑browser version is responsive letting basic functions like payroll, records access, or paystub checks happen on the go.

✅ 2.10 Security & Compliance / Data Protection

Gusto uses secure encryption for data transfer, regular backups, and supports multi-factor authentication to protect sensitive payroll and HR data.

🟢 Additional Gusto Features (Concise Version)

✅ 2.11 Tax Filing & Compliance

Gusto automatically handles federal, state, and local payroll tax filings. It ensures accurate withholdings and submits all required forms including W-2s and 1099s without manual effort. This reduces the risk of tax penalties and keeps your business compliant.

✅ 2.12 HR Management & Document Storage

Beyond payroll, Gusto acts as a lightweight HR platform. You can store employee documents, track job histories, and manage digital signatures. New hires complete onboarding forms online, and all paperwork is stored securely in one place.

✅ 2.13 Custom Reports & Analytics

Gusto offers detailed payroll, tax, and benefits reports. You can customize them by date, employee, or department, and export to CSV or PDF. These insights help small businesses monitor costs and plan ahead.

✅ 2.14 Employee Portal Access

Each employee gets their own login to view pay history, tax forms, benefits, and PTO balances. This self-service feature saves HR time and gives employees full transparency.

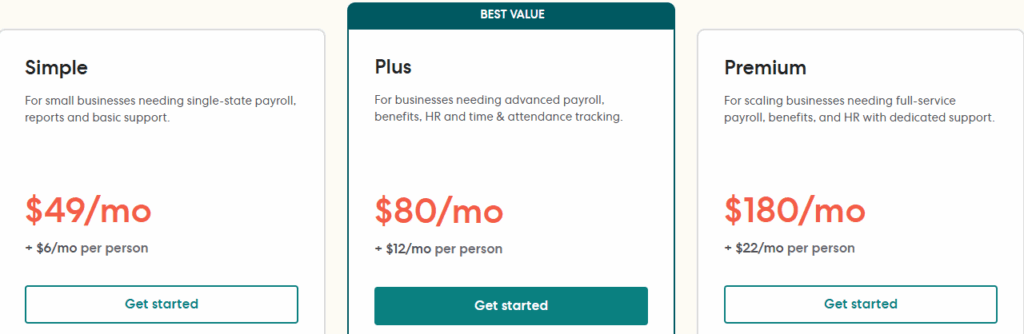

📌3. Gusto Pricing: Plans That Fit Different Business Sizes

Gusto offers four pricing tiers depending on your business needs:

| Plan | Base Price (Monthly) | Per Person Fee | Best For | Key Features |

|---|---|---|---|---|

| Simple | $49/mo | $6/mo per person | Small businesses needing basic payroll |

– Single‑state payroll – Unlimited payroll runs – Automated tax filings – Employee self‑service portal |

| Plus | $80/mo | $12/mo per person | Growing teams needing HR & time tools |

– Multi‑state payroll – Next‑day direct deposit – Time tracking & PTO – Hiring and onboarding tools – Health benefits management |

| Premium | $180/mo | $22/mo per person | Scaling companies with advanced HR needs |

– Dedicated service advisor – Certified HR expert access – Performance tools – Custom reports & analytics – Priority support & migration |

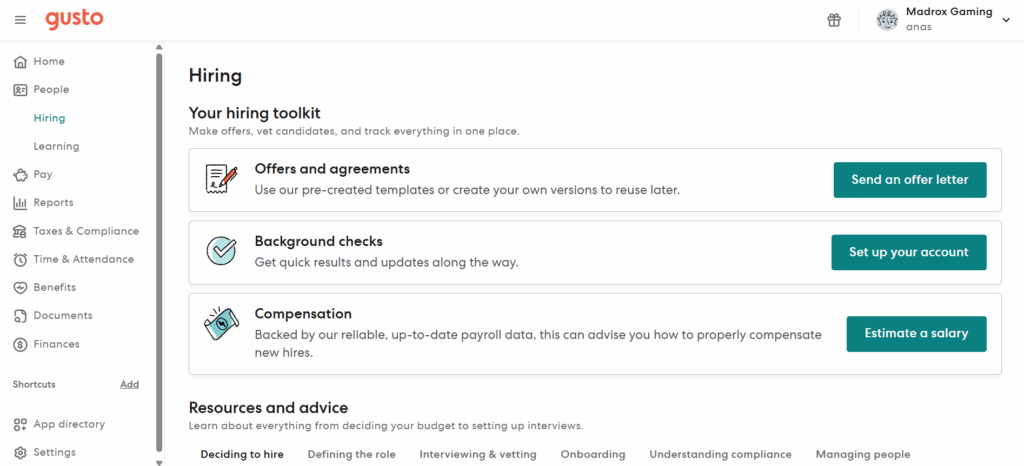

📌4. How Easy Is Gusto to Use? A Look at Its Interface

Gusto is known for its clean and simple interface. Even if you’ve never used payroll software before, it guides you step-by-step from setting up your company to running your first payroll.

The main dashboard shows you upcoming tasks like paydays, tax filings, and new hire actions. Everything is well-labeled, and you’ll see helpful tooltips throughout, so there’s no confusion.

Employees get their own login to check paystubs, tax forms, and benefits which means fewer questions for HR. And while there’s no full employer app, the mobile-friendly site still works well for most tasks.

In short, Gusto is built to feel easy even for non-tech users making it a great choice for small business owners.

- Gusto borrows smart CRM-like features so HR tasks feel more like managing relationships than paperwork. (Why CRM is becoming essential for HR →)

📌5. Gusto’s Customer Service: Is It Really Helpful?

Gusto offers support through live chat, phone (on higher plans), and email. While setup is mostly self-guided, many users say the help center articles are clear and easy to follow.

However, some users report mixed experiences with Gusto’s customer service. For basic questions, live chat usually works well. But for complex issues like tax adjustments or form corrections, replies can take longer especially during tax season.

So, while Gusto’s support is available, it may not be super fast every time. Businesses needing frequent or high-touch support might find this limiting unless they upgrade to higher plans.

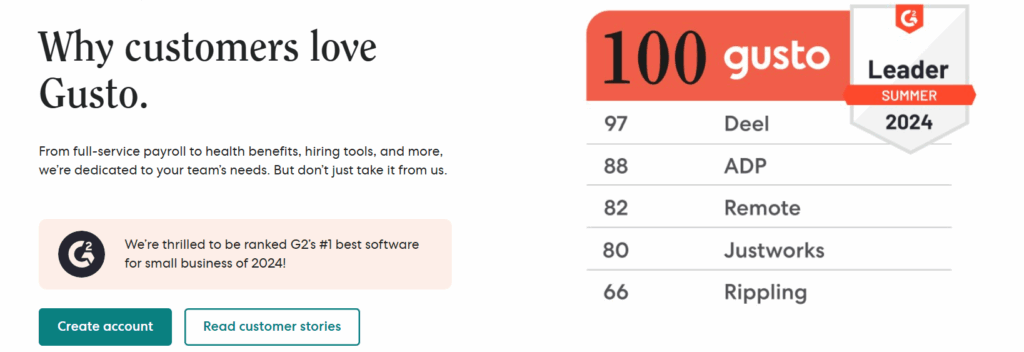

📌6. Gusto Reviews and Ratings

Across the web, Gusto generally gets positive ratings. Most small business owners love how easy it is to run payroll and how it simplifies taxes. On sites like Capterra and Trustpilot, Gusto scores around 4.5 out of 5 stars.

Common praise includes:

- Clean and easy-to-use interface

- Automatic tax filing

- Smooth employee onboarding

But some negative feedback points to delayed support and limited features for larger teams.

Still, for businesses with fewer than 50 employees, user feedback is largely positive especially when switching from manual processes or Excel sheets.

📌7. Gusto vs Competitors: Quick Comparison

When you search for payroll or HR tools, you’ll often see names like Rippling, QuickBooks Payroll (or simply QuickBooks), or ADP all of which claim to handle payroll and HR. But each has a different user‑profile, and Gusto stands out for simplicity and small‑team friendliness.

✅ Gusto vs Rippling

Rippling offers deeper automation and global payroll, making it great for fast-growing or international companies.

Gusto is better for small U.S.-based teams who want a simple, affordable tool with all core HR and payroll features.

✅ Gusto vs QuickBooks Payroll

QuickBooks Payroll works best if you’re already using QuickBooks for accounting and want everything in one system.

Gusto provides more HR features, better automation (like tax filing), and a cleaner interface for small business owners.

✅ Gusto vs ADP

ADP serves larger businesses with complex needs like compliance, workers’ comp, and global teams.

Gusto is ideal for small to mid-sized businesses looking for ease of use, flexibility, and lower cost.

📌 Summary:

- Choose Gusto if you need simple, reliable payroll & HR for a small team.

- Choose Rippling if you’re scaling fast and need more advanced control.

- Choose QuickBooks Payroll if you’re already using their accounting tools.

- Choose ADP if you’re an enterprise with high-volume HR demands.

📌8. Who Should (or Shouldn’t) Use Gusto?

Use Gusto if:

- You want to automate tax filing and benefits

- You have a small to mid-sized business

- You want an easy payroll system without hiring an accountant

- You’re managing remote or hybrid teams

Avoid Gusto if:

- You need deep integrations with custom software

- You’re scaling quickly and need advanced enterprise tools

- You want 24/7 human support on all plans

Gusto is built for simplicity, not complexity.

📌9. Gusto Pros & Cons

| Pros of Gusto | Cons of Gusto |

|---|---|

| Super easy to use, well‑suited for beginners and small business owners. | Not ideal for large or global companies because it is mainly focused on the U.S. market. |

| Full‑service payroll with automated tax filing and unlimited payroll runs. | Overall costs rise as more states or advanced HR features are added. |

| Built‑in HR tools such as onboarding, benefits, time‑off tracking, and document management. | Customer support response times can be slow according to some users. |

| Very convenient for contractors thanks to fast payments and automatic 1099 forms. | Offers fewer customization options compared with large enterprise HR systems. |

| Clean dashboard and employee self‑service portal that reduce admin workload. |

10. Is Gusto Worth It? Final Thoughts

If you’re a small business owner tired of spreadsheets, manual tax filing, or HR headaches, Gusto is definitely worth a look.

It’s simple, modern, and powerful enough to run payroll, onboard employees, and manage benefits all from one place.

It’s not perfect, especially if your team is large or your needs are complex.

But for most growing teams under 50 employees, Gusto strikes the right balance between ease and features.

👉 Overall: Gusto offers the right balance of features, pricing, and ease-of-use making payroll and HR stress-free for small businesses.

“Must Read” : Gusto Free Trial: Get 3 Months of Payroll & HR Tools Free

❓ Frequently Asked Questions (2026)

1. Does Gusto offer a free trial?

Yes, Gusto offers a free demo and trial so you can explore the platform before committing.

2. Can I use Gusto if I only hire contractors?

Yes, Gusto has a Contractor-Only plan starting at $35/month + $6 per contractor.

3. Is Gusto available in all U.S. states?

Yes, Gusto operates in all 50 U.S. states and supports both single and multi-state payroll.

4. Does Gusto handle tax form filing?

Absolutely. Gusto automatically files federal, state, and local taxes, plus year-end forms like W-2s and 1099s.

5. Can employees access their own pay info?

Yes, employees get their own self-service portal to download paystubs, update details, and view tax forms.

6. Does Gusto integrate with accounting software?

Yes, it integrates smoothly with tools like QuickBooks, Xero, FreshBooks, and more.