Thinking of switching to a smarter way of running payroll?

You’re in the right place. In this guide, we’ll break down Gusto Payroll a tool that claims to make paying your team as easy as clicking a button. 🖱️

👉 Whether you’re tired of messy spreadsheets or just want a stress-free payroll solution, this review will walk you through how Gusto works,

what makes it special, and if it’s really worth your time and money.

Let’s dive in and see if Gusto can actually deliver on its promise of “shockingly easy” payroll!

📌 Gusto Payroll Key Features Explained (2026)

1. Direct Deposit

Forget writing checks. Gusto deposits salaries directly into your employees’ bank accounts fast, safe, and on time.

2. Automatic Tax Filing

Gusto calculates, files, and pays all your payroll taxes federal, state, and local. You don’t have to worry about tax forms or missed deadlines.

3. 1099 eFiling for Contractors

If you work with freelancers or independent contractors, Gusto makes it easy to send out 1099s automatically during tax season.

4. Employee Self-Service

Employees get their own login to check paystubs, tax forms, and personal info. You don’t have to manage every small request.

5. Hourly & Salaried Payroll

Whether your team is hourly, salaried, or mixed Gusto handles the calculations and pay differences without mistakes.

6. Flexible Payroll Runs

You’re not stuck to a single schedule. Gusto allows off-cycle runs too perfect for bonuses or corrections outside the normal pay cycle.

7. Tax Management & Compliance

Gusto stays updated with tax laws, so your filings stay compliant no need to double-check rules or hire outside help.

8. Integrated Payroll System

Gusto connects with your favorite tools like QuickBooks, Xero, and TSheets so everything works smoothly in one system.

9. Shift Scheduling Support

Gusto supports basic shift scheduling or lets you integrate tools like Homebase for more detailed employee hours.

10. Works Across Devices (Mac, Desktop, Mobile)

Whether you’re on a desktop (Windows or Mac), Gusto works flawlessly in your browser. No software to install.

11. Secure Payroll Processing

Your company’s sensitive payroll data is encrypted and stored securely. Only authorized users can access it.

12. Off-Cycle Payroll Support

Sometimes things come up bonuses, missed payments, or urgent payouts. Gusto allows you to process these easily, without extra fees.

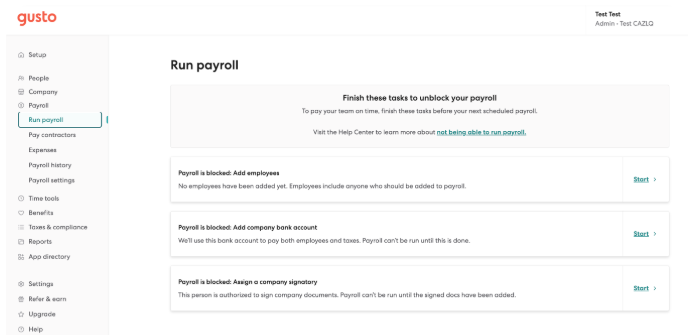

⏱️ How Gusto Payroll Works: Step‑by‑Step Setup & Run

One of the biggest reasons small businesses choose Gusto is because onboarding and payroll setup is incredibly simple no accounting degree needed. Here’s how it actually works:

🧩 Step 1: Add Your Business Details

Enter your business name, address, tax ID (EIN), and any state filing information.

Gusto uses this data to handle payroll taxes automatically.

👥 Step 2: Add Employees or Contractors

Choose the worker type and enter:

- Pay rate (hourly or salary)

- Bank account details

- Work location

- Benefits or deductions (if any)

Employees get their own portal to complete onboarding digitally huge time-saver.

🗓️ Step 3: Choose a Pay Schedule

Weekly, bi‑weekly, semi‑monthly, or monthly totally up to you.

You can even set different schedules for different roles.

💼 Step 4: Track Hours & Approvals

If you run hourly payroll:

- Enter hours manually

- Sync time tracking from tools like Homebase or TSheets

Everything gets calculated instantly: wages, taxes, benefits, overtime.

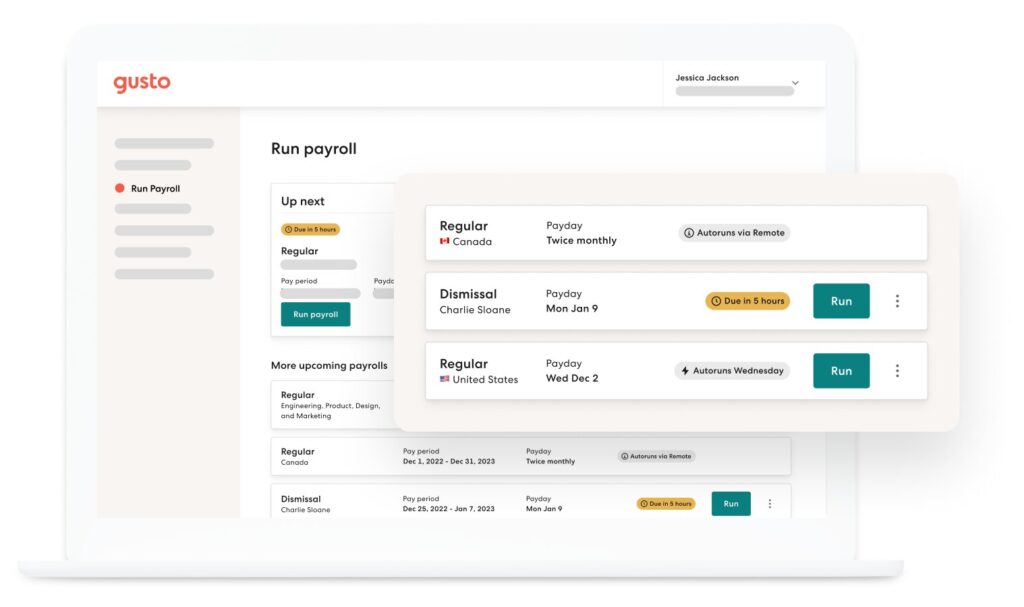

💸 Step 5: Review Payroll & Run It

Before finalizing, Gusto shows a clean preview of:

✔ Earnings breakdown

✔ Employer taxes

✔ Deductions

✔ Net pay to employees

Click “Run Payroll” and you’re done. 🎉

Direct deposits automatically hit accounts on payday.

🧾 Step 6: Gusto Files Your Taxes Automatically

After payroll runs, Gusto takes over:

- Files federal, state & local taxes

- Sends W‑2s and 1099s at year‑end

- Handles tax updates so you stay compliant

No extra clicks… no government portals… no stress 😅

📌 Gusto Payroll Pricing & Plans (2026 Breakdown)

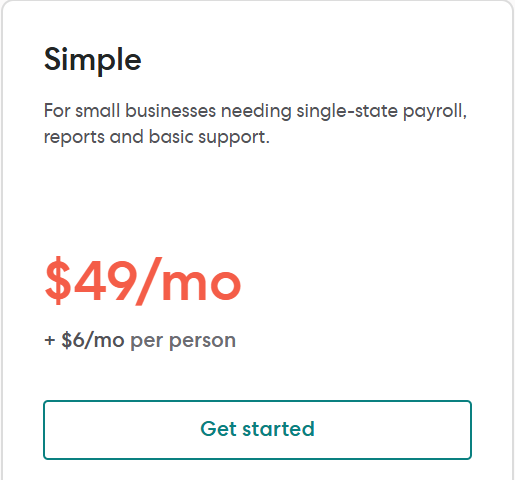

Gusto offers 3 main pricing plans with no contracts and no hidden fees. You only pay a base monthly fee + a per-employee rate.

1. Simple Plan – $49/month + $6 per person

For small teams needing just the basics.

- Full-service single-state payroll

- Unlimited payroll runs

- Automatic tax filings

- Employee self-service portal

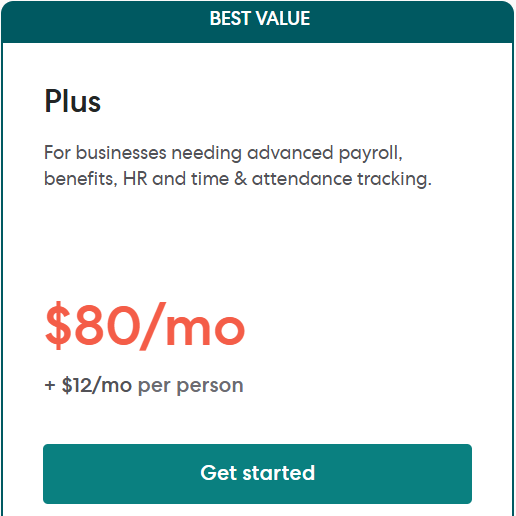

2. Plus Plan – $80/month + $12 per person

Ideal for companies growing beyond basics.

- Everything in Simple, and:

- Multi-state payroll

- Next-Day Direct Deposit

- Time tracking & PTO management

- Hiring & onboarding tools

- Health insurance admin & broker integration

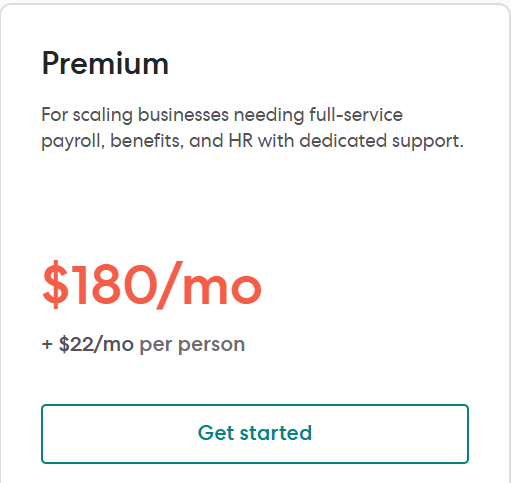

3. Premium Plan – $180/month + $22 per person

For scaling businesses with bigger HR needs.

- Everything in Plus, and:

- Dedicated customer success manager

- Certified HR expert support

- Performance management tools

- Advanced reporting & analytics

- Migration & priority support

Looking for the best Gusto coupon code? You’ve come to the right place! Unlock exclusive discounts for Gusto Payroll, and start saving on payroll processing today.

📌 Payroll vs Competitors: Key Comparisons

Compare Gusto Payroll with rival payroll tools to see which suits your business best we look at features, pricing, flexibility, and support side‑by‑side.

| Feature | Gusto | QuickBooks Payroll | Rippling | OnPay |

|---|---|---|---|---|

| Auto Tax Filing | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Contractor-Only Plan | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| HR Tools | Basic (Plus+) | Moderate | Advanced | Limited |

| Ease of Use | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Support Quality | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

📌 Pros & Cons of Gusto Payroll Software

| Pros of Gusto Payroll | Cons of Gusto Payroll |

|---|---|

| Super easy to use, even for non‑HR people. | Customer support can be slow during busy tax season. |

| Automatic tax filing saves hours every month. | Time tracking is not very advanced and often needs integrations. |

| No hidden fees for running payroll multiple times. | Not the cheapest option; some alternatives are more affordable. |

| User‑friendly employee self‑service portal. | HR tools are mostly included only in higher‑tier plans. |

| Mobile‑friendly on both desktop and phone. | |

| Trusted by hundreds of thousands of small businesses. |

📌 What Real Gusto Payroll Users Are Saying

Gusto has a 4.6/5 rating on most platforms like PCMag, Capterra, and G2.

🔵 Positive Reviews:

“Gusto made payroll a breeze. I don’t worry about taxes anymore.”

“My contractors love how easy it is to get paid on time.”

🔴 Negative Reviews:

“Support is hit or miss when you need help, you may have to wait.”

“Some small glitches during year-end forms, but nothing major.”

📌 Is Gusto Payroll Right for Your Business?

If you’re looking for a simple payroll solution with minimal hassle, Gusto is likely a great fit for your small or growing business. Here’s who should consider using Gusto:

✅ Ideal for Small to Mid-Size Businesses

- Businesses that want automated payroll without hiring a dedicated HR team.

- Small teams that need payroll + tax filing all-in-one with no hidden fees.

- Companies with remote workers who need multi-state payroll support.

✅ Best for Teams Wanting to Focus on Compliance

- Gusto handles tax filing, employee benefits, and reporting automatically, freeing you from these tasks.

✅ Good for Simplicity, Not Advanced Customization

Gusto is perfect if you’re looking for something easy-to-use. However, if you need complex workflows or deep integrations, you may want to consider a more flexible platform like Rippling or QuickBooks Payroll.

📌 Final Verdict: Is Gusto Payroll Worth It in 2026?

✅ Yes, Gusto Payroll is Worth It in 2025!

If you’re a small business or freelancer, Gusto is an excellent payroll solution. It simplifies payroll processing, tax filings, and employee management, making it ideal for teams looking to avoid the complexity of manual payroll.

Why Gusto is Worth It:

- Automated tax filing saves time and ensures compliance.

- Mobile-friendly interface lets you manage payroll from anywhere.

- Affordable pricing for small businesses with no hidden fees.

- Comprehensive HR tools like benefits management and employee onboarding.

Why It Might Not Be Right for You:

- Limited customization options may not be ideal for large or highly complex teams.

- Customer support can be slow during tax season, which can be frustrating when you need help fast.

Final Takeaway:

For small teams or freelancers seeking a simple, efficient payroll solution, Gusto is definitely worth it. It combines ease of use with powerful automation at an affordable price. However, if you need a highly customized setup, you may want to explore other options like Rippling or QuickBooks Payroll.

“Related Articles”

FAQs (Quick Answers)

❓ 1. Can I run payroll automatically with Gusto?

Yes, with Gusto’s AutoPilot feature.

❓ 2. Does Gusto support contractor payments?

Yes, via a contractor-only plan at $6/month per contractor.

❓ 3. Is Gusto good for restaurants or hourly staff?

Yes, especially when integrated with tools like Homebase.

❓ 4. Does Gusto handle garnishments or deductions?

Yes, it supports custom deductions and wage garnishments.

❓ 5. Can I switch to Gusto mid-year?

Yes, Gusto allows mid-year setup with data import support.